Superimposed on the recent launch (and massive funding) SoFi, a new startup launching today, it wants to breathe a breath of fresh air in the system of student loan broken, complex and slow in the molasses.

CommonBond based in New York is designed to bring the power of crowdsourcing on debt of student correspondence studies borrowers and investors of the ancients and offering loans at a fixed rate lower than they would be with Uncle Sam. To revive this initiative, start announced Friday that it has raised 3.5 million $ in external financing.

The three co-founders of CommonBond - David Klein CEO, CFO Michael Taormina and Advisor Jessup Shean - are graduates of the University of Pennsylvania Wharton, and therefore the startup has raised 2.5 million $ from investors of the elders to pay student loans. They raised an additional 1 million $ of angels to take advantage of its activities.

Why is it important? Well, because you have heard of this story before: the price of a college education has become unsustainable. Thanks to the ridiculous tuition today inflation, student debt is at a record level. Young graduates are more and more being under-employed (if not in unemployment) and the graduation rate slipping as a result.

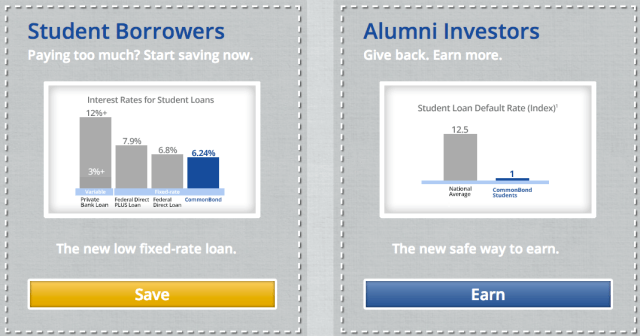

In turn, when students should subsidize their studies, they are forced to deal with some pretty unattractive in the loan Department. Federal loans come with high fixed interest rates and loans from private banking, while the variable, are even more serious, to come somewhere near 12%. More broadly, those seeking a personal loan (say, pay off the credit card debt) finds the same ugly reality. This is why we have seen an increase in the popularity of peer-to-peer lending platforms big lately, with companies such as LendingClub and Prosper at the forefront.

P2P lending platforms essentially turning to crowdsource investment (individuals, institutions, etc.) in loans of people, between the people who want to borrow money to those who want to invest in something with stable yields. The bonus? Cut the Bank as an intermediary.

Naturally, there are many who believe that the P2P model of crowdsourcing may work as well in education for student loans. Really, even slightly better than the current standard will be a huge improvement. And CommonBond has made a good start, although it is still too early. The company aims to start MBA programs, specifically Wharton, where it will fund up to 100 of his students in the MBA from this semester, before expanding across national beginning next year.

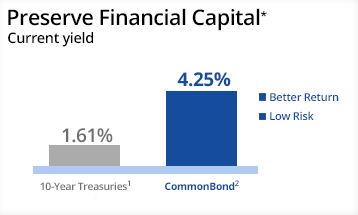

Under model CommonBond, students pay a 6.24% fixed interest rate, amounting to co-founders what will be the equivalent of 20 K $ savings during the repayment of the loans. This is compared with traditional alternatives, such as federal loans, which tend to come with around 8 percent interest rates. On the other side, former investors can expect an annual efficiency of over 4%, the company tells us.

It is not quite as attractive for investors as the loan options to, say, LendingClub, but simply to invest in student loans - traditionally not something that was attractive or even on the radar-individual or institutional investors. Due to the relatively high bank or federal loan rates, students end up repaying their loans over the years, and many end up by default - then what investor in their right mind would want to invest?

Peer-to-peer and crowdsourced debt investment and refunds of this type are still relatively new to the average consumer, the barrier to entry can be significant. There are risks, no doubt. [See discussion of Peter Renton for more information] Beyond the defaults, there is the issue of self-protection, not remaining diverse, interest rates and regulatory changes - the latter which are related to a given time.

But, that being said, the P2P lending as a whole industry WINS in popularity and being validated, in part by increasing the interest of institutional investors. More, the students want to get out of debt, they do not want to be reimbursed for decades, and banks are not exactly ready their butts off right now.

But, that being said, the P2P lending as a whole industry WINS in popularity and being validated, in part by increasing the interest of institutional investors. More, the students want to get out of debt, they do not want to be reimbursed for decades, and banks are not exactly ready their butts off right now.

For education, in particular, it is all about the creation of a community of trust and goes beyond being a financial resource to develop sustainable links between the Alumni and students. This could mean entry into professional network or events, alongside financing loans. Of course, to do all this and be successful in this space, startups must raise much financing. CommonBond is just to start and he received funding already to his credit, but he has a long way to go to catch up with $75 million of SoFi.

However, there a few Warby Parker and TOM like her Philanthropy: it brings the individual model for education and for each degree is entirely funded on CommonBond, startup will fund the training of a student in need (Overseas) per year. It is a start in partnering with the African School for Excellence. What isn't awesome about it?

Ultimately, however, it is probably more of a handful of winners, but now the problem of student debt is huge - which can hardly be underestimated, and there are plenty of green space. In addition, as the P2P and the willing crowd-powered reach the general public, this space will certainly become more attractive for investors - corporate, institutional or other.

As it does, the startups that can provide cheap rates for students, the constant returns for investors and develop a course, Community added value around loan will do well. That is more easily said than done, of course, but there is a potential for this new model have a tremendous effect on education. And that is money in the Bank.

Image via

Student loans market of US $ 1 trillion is broken. SoFi uses the power of social networks to transform the industry. SoFi connects students and alumni through a dedicated loan fund. Alumni win a double low line wrap, students receive a less than their options private or federal loan rates, and both sides have formed connections. Schools access to a new, stable, low-cost financing source that does cannibalism giving about strengthening accountability to their students and...

? Learn jQuery (function () {jQuery("#tabs-crunchbase").tabs ()});

? Learn jQuery (function () {jQuery("#tabs-crunchbase").tabs ()});

Post a Comment